Trade Wars: Fields of Uncertainty

The smell of freshly turned soil, the crisp spring air, and the promise of new seeds flowering into a livelihood. The encouraging sights, smells, and sounds of spring planting bring a welcome refresh to farmers across rural America after a long winter and challenging 2024 crop year. The unpredictability of moisture weather patterns from March to June introduces significant uncertainty into a farmer's life. On top of that, American farmers' agricultural rhythms will also face the drumbeat of uncertainty from the shifting tides of trade policy.

Agricultural tariffs have long been a powerful trade policy tool, used either to protect domestic production or as leverage in geopolitical negotiations. One of the earliest tariff policies impacting agriculture was the Smoot-Hawley Tariff of 1930, which raised U.S. tariffs on more than 20,000 imported goods. As the U.S. was still largely agrarian at the time, this policy exacerbated the effects of the Great Depression for American farmers. Over the years, trade conditions gradually improved, particularly with key agreements like the General Agreement on Tariffs and Trade (GATT), signed in 1947 by 153 countries to reduce global trade barriers. For U.S. farmers, this meant greater access to international markets, increasing exports, and driving growth across agricultural sectors. However, GATT also led to increased competition, as foreign producers could more easily enter the U.S. market, challenging domestic farmers to improve efficiency to compete with global production and pricing pressures.

In 1995, the World Trade Organization (WTO) was established, further structuring trade relations and providing a stronger framework for protections, regulations, and dispute resolution. While the WTO has facilitated broader access to global markets in agriculture, it has also introduced more stringent policies on subsidies and domestic support programs. Agriculture has traditionally relied on many of these programs to mitigate the vagaries of weather patterns and commodity markets.

Sowing the Seeds of Trade Tensions

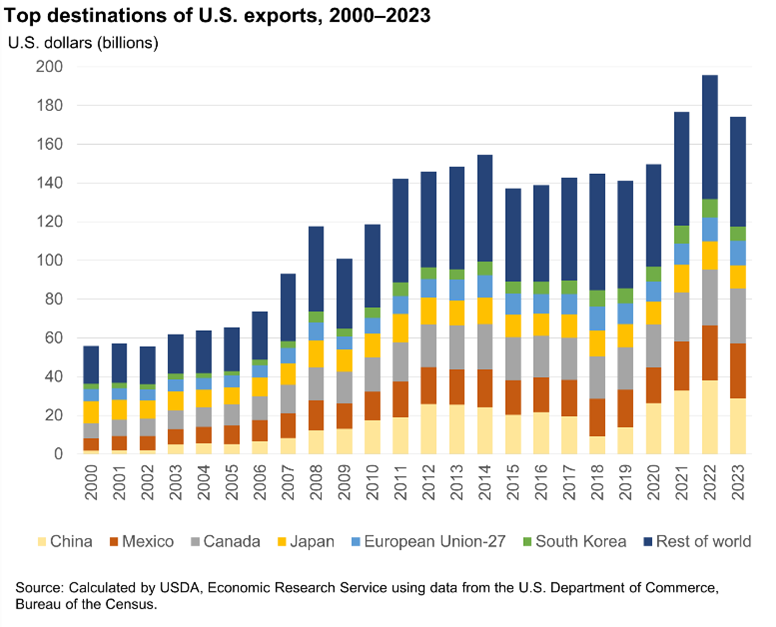

In 2017, the Trump administration imposed sweeping tariffs on steel and aluminum imports, prompting swift retaliation from major U.S. trading partners, particularly China. In response, China levied steep tariffs on American agricultural exports, including soybeans, corn, pork, and dairy products. Given that China was the largest export market for U.S. soybeans at the time, these tariffs delivered an immediate and painful blow to American farmers. Before 2023, China was the top destination for U.S. agricultural products. However, this relationship has shifted markedly, and by the end of 2025, China is projected to be third on the list.

Source: USDA

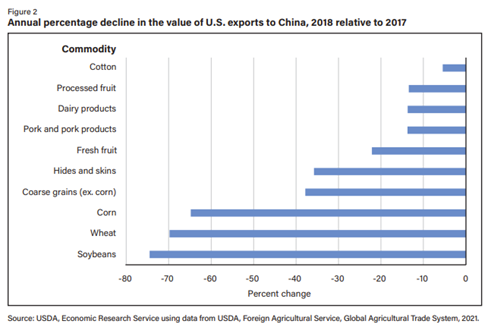

According to the USDA’s Economic Research Service, U.S. soybean exports to China plummeted by over 70% following the implementation of 2017 tariffs, forcing farmers to seek alternative markets and relying on government subsidies to offset farming losses. During this time, China began importing much of its soy requirements from Brazil, which had recently emerged as a world leader in the space. China has continued to source more and more soybeans from Brazil. The Trump administration responded with the Market Facilitation Program (MFP), which provided nearly $28 billion in aid to affected farmers between 2018 and 2019. However, the uncertainty about a further souring of Chinese trade relations has left many in agriculture concerned about the long-term stability of global demand for soybeans and other crops. Relying on Federal subsidies or relief payments each time tariffs have an adverse effect on Chinese demand is not a sustainable solution in the long run.

Source: USDA

Weathering the Storm: The Impact of Tariffs on Farm Income and Farmland

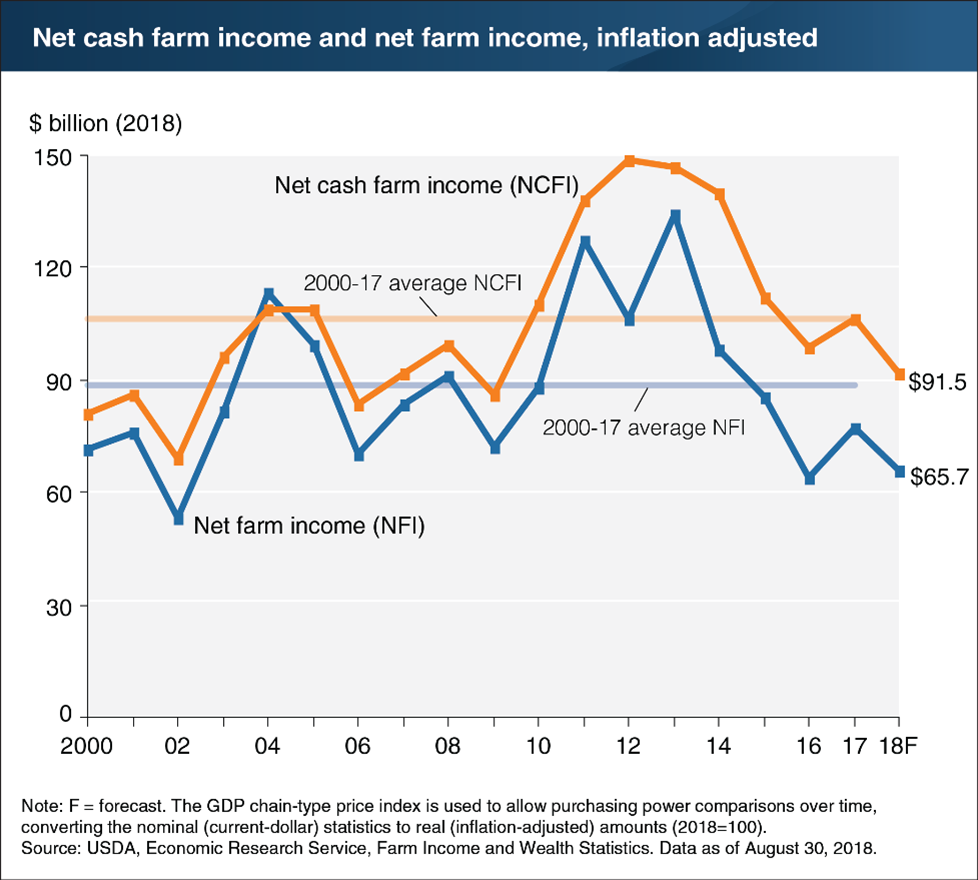

As the chart above depicts, the economic fallout from the 2017 trade war with China has extended beyond soybeans with wheat and corn trade with China also down by more than 60% in the following year. The USDA reported that overall farm income saw significant declines, with net farm income dropping nearly 16% in 2018 compared to pre-tariff levels (USDA Economic Research Service). The retaliatory tariffs also reduced agricultural commodity prices, making it harder for farmers to make a profit.

Source: USDA

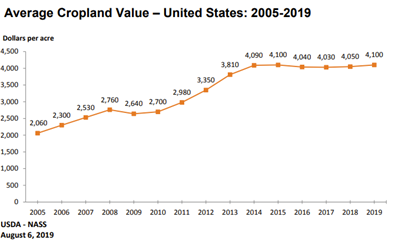

Despite these trade pressures, it is very rare for farmland values to experience a steep decline, as land is generally an appreciating asset. However, during this period, land values leveled off due to lower commodity prices on lower demand for U.S. soybeans and other major commodities. After the COVID-19 pandemic, farmland values rebounded and saw significant appreciation, but they have since leveled off as commodity prices have declined. If commodity prices continue on their current downward trend, it is unlikely that farmland values will see any meaningful appreciation in the near future.

Source: USDA

The 2025 Tariff Landscape: A Return to Trade Wars?

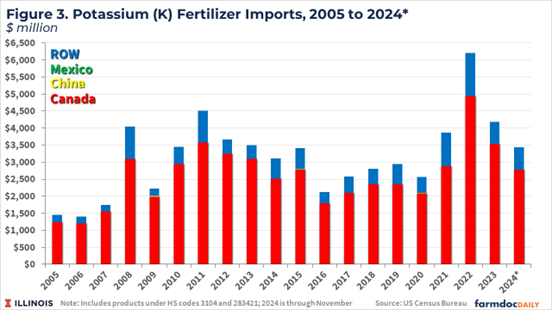

Having seen what happened in agricultural commodity markets in the aftermath of the 2017 trade war, let’s fast forward to 2025. Trump has returned to the White House and has once again made tariffs a central focus of his economic policy. In an effort to reduce fiscal budget deficits and boost domestic manufacturing, the administration has reintroduced tariffs on several key imports and trading partners. Canada, Mexico, and China—America’s largest trading partners for both agricultural imports and exports—are all targets of President Trump’s tariff negotiations. Considerable agricultural machinery is manufactured in Mexico, while some crop inputs, such as fertilizers like potassium, are largely produced in Canada. These proposed tariffs could not only raise the costs of these inputs but also lower commodity prices for farmers as agricultural buyers shift their demand to international competitors.

Source: Farmdoc Daily

New tariff proposals on Chinese goods have reignited fears of retaliatory action by China against U.S. agricultural exports. In February 2025, China announced potential countermeasures that could target American corn and beef, raising concerns among producers already grappling with higher production costs and fluctuating global demand. A Farm Bureau analysis suggests that these tariffs could lead to a 10-15% decline in U.S. agricultural exports to China, exacerbating economic pressures on U.S. farmers.

Long-Term Consequences: Protection or Peril?

The broader question remains: do tariffs ultimately benefit or harm American agriculture? Proponents argue that they encourage domestic production and reduce reliance on foreign markets, fostering self-sufficiency in key industries. However, critics contend that retaliatory measures, combined with increased input costs, place farmers in a precarious position.

A 2025 report from farmdoc daily highlights that, while tariffs may offer short-term political leverage, they create long-term volatility that disrupts supply chains and weakens U.S. competitiveness in global agricultural markets. Additionally, while government aid packages can provide temporary relief, they do not offer a sustainable solution to the broader challenges facing the agricultural sector.

In light of these trade disruptions, Brooke Rollins, Trump’s U.S. Secretary of Agriculture, has outlined a strategic vision aimed at supporting farmers and revitalizing rural America. In her opening remarks at the USDA, she emphasized refocusing the department on its core mission of serving farmers and ranchers. At the Commodity Classic, Rollins announced the Emergency Commodity Assistance Program (E-CAP) to distribute $10 billion in economic and disaster aid to farmers, alongside releasing funds for programs like the Environmental Quality Incentives Program (EQIP), Conservation Stewardship Program (CSP), and Agricultural Conservation Easement Program (ACEP). She has also advocated for repealing the "death tax" to protect family farms, encouraging businesses to relocate production to small towns, and collaborating with Congress on a new farm bill to provide long-term stability for producers. These initiatives reflect a strategy centered on financial support, deregulation, and rural economic development.

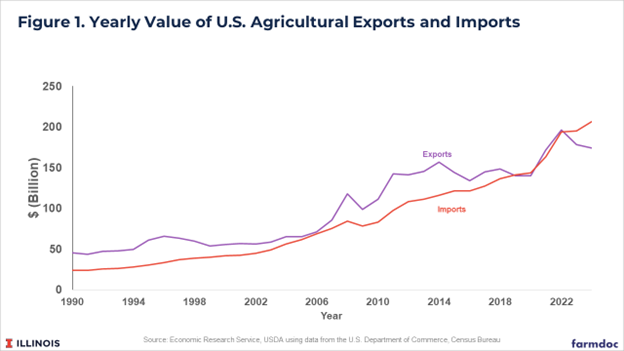

Navigating the Future: Strategies for Resilience

As farmers navigate the ongoing uncertainty of trade wars, many are implementing strategies to protect themselves from economic turbulence. Key approaches include expanding export markets beyond China, investing in technology to enhance efficiency, and advocating for policy stability. President Trump has emphasized the need to strengthen domestic markets for agricultural products, particularly as the U.S. faces a negative agricultural trade balance despite being an agricultural powerhouse. However, this imbalance is largely driven by the high-value horticulture industry, including imports of fresh flowers, fruits, vegetables, and nut trees, rather than the lower-value bulk commodities such as corn and soybeans that dominate U.S. agriculture. Expanding domestic horticultural production presents significant challenges, as many of these crops require equatorial climates, making large-scale production in the U.S. difficult.

Source: Farmdoc Daily

It seems likely that the Trump Administration’s plans for rural economic development referenced by USDA Secretary Rollins are linked with plans to increase domestic use of corn, soybeans, and wheat. Research suggests development plans include boosting ethanol production for corn, promoting biodiesel for soybeans, and supporting food uses for wheat, though specific details are still emerging. Strategic plans also include supporting the livestock industry to increase feed demand for corn and soybeans, with less clarity on wheat-specific strategies. Potential Administration plans for increasing domestic commodity crop uses are as follows:

Corn

The Administration appears to be prioritizing ethanol production, likely by expanding blending mandates or offering tax incentives, given past support for the ethanol industry, especially in Corn Belt states like Iowa. Additionally, supporting the livestock industry could boost corn use as animal feed, helping boost domestic demand for corn.

Soybeans

Administration plans also seem to include promoting biodiesel production from soybean oil, possibly through incentives for its use in transportation, reflecting previous efforts to support biofuels and sustainable aviation fuel. Similar to corn, increasing livestock production could raise demand for soybean meal, aligning with the domestic market focus.

Wheat

For wheat, the Administration strategy is less clear but likely involves supporting the baking industry and increasing its use in government food programs, such as school lunches, to enhance domestic consumption. However, specific initiatives are harder to pinpoint compared to corn and soybeans.

Building new infrastructure for ethanol, biodiesel, and livestock production takes years and significant resources, and there may be a time lag before domestic demand can fully compensate for lost international demand. The transition from international markets to domestic consumption comes with risks and uncertainties. Some agribusiness companies may decide it’s better to sit on the sidelines until greater clarity and specificity around the Administration’s agricultural transition plans have been provided.

As the 2025 trade landscape continues to evolve, U.S. agriculture finds itself at a crossroads, navigating an uncertain future shaped by policy decisions beyond its control. The Administration has plans to mitigate export losses by enhancing domestic consumption, though their effectiveness depends on implementation and market response. The promotion of local processing facilities offers an unexpected but promising avenue for long-term domestic market development. Whether these strategic initiatives ultimately yield prosperity or prolonged instability remains to be seen, but one thing is certain: American farmers will continue to adapt, innovate, and persevere through the ever-changing fields of uncertainty.

If you enjoyed this article, check out these other articles about Opportunities:

Land Investment Expo 2025