OZ 2.0 Takes Aim at Rural America: Triple Basis Step-Ups and Lower Barriers to Scale Impact

Introduction

Since its inception, the Opportunity Zone (OZ) program has mobilized nearly $100 billion in private capital, establishing itself as one of the most significant place-based economic development initiatives in the history of the United States. However, data from the Economic Innovation Group and the Joint Committee on Taxation indicates that the initial iteration of the program, OZ 1.0, saw investment flow disproportionately toward urban centers. While the program was successful in many regards, only an estimated 10% of total OZ capital reached rural low-income communities despite an estimated 40% of eligible tracts being considered rural in nature.

With the enactment of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025, the landscape has shifted significantly. This legislation not only codified the Opportunity Zone program as a permanent economic tool but also introduced specific, powerful incentives designed to correct the previous urban-rural capital imbalance. By creating a distinct category and related incentives for rural OZ investment—the Qualified Rural Opportunity Fund (QROF)—policymakers have effectively widened the path for capital to flow into America’s agricultural heartland. For tax practitioners and investors, understanding the mechanics of these new rural-specific incentives is essential for planning future capital deployment.

A Permanent Framework for Investment

The most fundamental change introduced by the new legislation is permanency. The original program was a temporary incentive scheduled to sunset, but the OBBBA has transitioned the OZ regime into a permanent fixture of the tax code.

Under this new "OZ 2.0" framework, the investment period officially begins on January 1, 2027. This reboot comes with a new map; governors in all 50 states must submit new census tract nominations by July 2026. While the general structure of deferring capital gains remains, the legislation introduces a bifurcation in benefits that heavily favors rural investment.

The Qualified Rural Opportunity Fund (QROF)

To access the enhanced rural benefits, investors must utilize a Qualified Rural Opportunity Fund (QROF). The legislation defines a QROF as a fund that invests at least 90% of its assets into designated "rural OZs." This distinction is critical. A standard Qualified Opportunity Fund (QOF) continues to offer attractive tax efficiency, but a QROF unlocks two specific "super-incentives" designed to effect change in rural economies: a significantly higher step-up in basis and a lower substantial improvement threshold.

Rural America’s Fundamental Case: Food, Fuel, and Fiber

While tax incentives provide the catalyst for capital movement, the underlying investment thesis for rural Opportunity Zones rests on its production of essential resources. Rural economies are generally anchored around the production of the necessities of life: food, fuel, and fiber. Because demand for these commodities is constant, the asset classes associated with their production—specifically cropland, pastureland, and agricultural facilities—have historically demonstrated unique economic resilience.

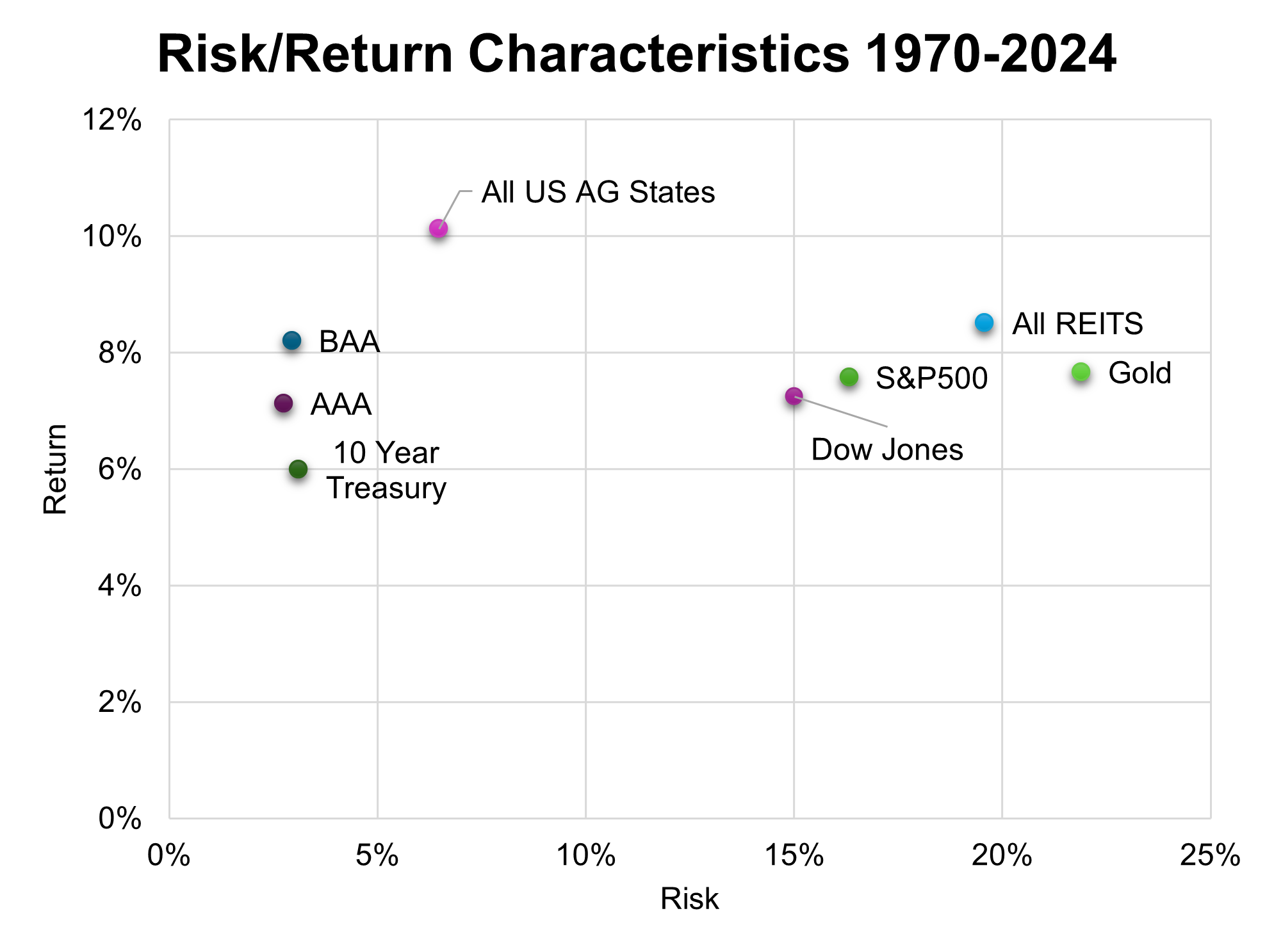

Data courtesy of the TIAA Center for Farmland Research at the University of Illinois covering the period from 1970 to 2024 highlights this attractive risk-reward profile. During this timeframe, farmland delivered equity-like returns of approximately 10% (outperforming the S&P 500 of approximately 8%) yet maintained a lower risk profile than the S&P 500 that was more comparable to bonds, with volatility near 7%. The underlying historical performance data suggests that rural assets can function as an inflation hedge similar to gold, but with the distinct advantage of generating annual operating income—effectively acting as a store of value with a "coupon."

[This Risk/Return Graphic is based on data from the TIAA Center for Farmland Research (1970–2024), farmland occupies a unique investment quadrant: offering equity-like returns (~10%) with the low volatility profile of fixed income (~7%).]

This stability is particularly relevant to the Opportunity Zone structure, which mandates a long-term hold. Historical performance indicates that farmland values appreciate at a spread of roughly 2% over inflation. Furthermore, the historical data shows that investors who held farmland for the 10-year period required by OZ rules would have remained in positive territory, even if they had purchased at market peaks preceding major economic downturns like the 1980s farm crisis. By coupling these fundamental attributes with the new OZ 2.0 incentives, the rural sector presents a compelling case for risk-aware, long-term capital.

Supercharged Incentive #1: The 30% Step-Up

The first, and perhaps most attractive, incentive for investors is the enhanced step-up in basis. Under the standard OZ 2.0 rules, an investor who holds their interest in a QOF for five years receives a 10% step-up in basis on the deferred taxes. This is a valuable benefit, effectively reducing the tax liability on the original capital gain by 10%.

However, the OBBBA provisions state that for investments made through a QROF, that benefit triples. Investors who hold their QROF investment for five years receive a 30% step-up in basis. This dramatic increase significantly alters the return profile for rural investments, offering a "buffer" that can make rural development deals competitive with potentially higher-yielding urban real estate development projects. This 30% step-up acts as a powerful

magnet for patient capital, rewarding investors for allocating capital to rural areas that have historically struggled to attract institutional capital.

Supercharged Incentive #2: The 50% Improvement Threshold

The second hurdle in the original OZ program was the "substantial improvement" requirement. To qualify for tax benefits, an investor purchasing an existing asset generally had to double its basis—investing $1 for every $1 of the asset’s value (excluding land) within a 30-month window. In rural settings, where asset values can be idiosyncratic and construction logistics more challenging, this 100% improvement threshold often proved challenging.

The new legislation directly addresses this potential impediment. For QROFs, the substantial improvement requirement is reduced to 50% of the property's acquisition basis (excluding land).

This lower threshold is a game-changer for agricultural operations, making a wider range of infrastructure upgrades economically viable. For example, a farming operation might not need to double the value of its existing improvements to increase the farm’s productivity. Under the new rules, a moderate investment in modernization of production facilities and farm equipment, such as grain bin storage, drainage and irrigation, now qualifies.

Practical Application: What Qualifies?

The OBBBA may also open the path for higher return seeking OZ investors to venture into downstream agricultural infrastructure. In addition to reauthorizing bonus depreciation on equipment with useful lives of 20 years or less, the OBBBA established similar accelerated depreciation on Qualified Production Property or QPP. Newly constructed facilities eligible for treatment as QPP would typically have IRS useful lives of 39 years, but if they meet the definition of QPP these assets can be fully depreciated in the year placed in service. QPP must be used for manufacturing, production, or refining activities. Eligible “production” activities under the OBBBA have been specifically limited to agricultural and chemical production. The legislation is also specific about what constitutes a qualified activity, focusing on the "substantial transformation" of personal property.

Practical examples of downstream agriculture infrastructure investments that could be feasible under the QROF structure include:

- Grain Milling: Facilities that process raw grain into feed or food products.

- Livestock Operations: Dairy milking parlors, poultry processing plants, and hog confinement facilities.

- Specialized Processing: Facilities for wool shearing, egg production, or aquaculture.

QPP within a QROF would offer a highly attractive investment for OZ investors while simultaneously modernizing the American heartland’s aging agricultural infrastructure.

Conclusion

The transition to Opportunity Zone 2.0 marks an important shift from a broad-brush approach to a more targeted economic strategy. By offering a 30% basis step-up and lowering the improvement barrier to 50%, the OBBBA acknowledges the unique economic realities of rural America. These incentives are likely to affect a meaningful movement of capital gains from traditional urban real estate into America’s breadbasket, offering investors tax efficiency while providing rural communities the opportunity to modernize agricultural infrastructure for the production of the necessities of modern life.

Article By: John Heneghan